Financial Wellness

- Home

- Focus

- Mental Wellness

Descriptions

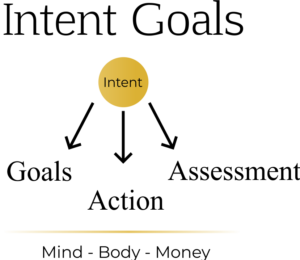

Unlock your financial wellness potential by improving relationships with money. This holistic approach integrates financial well-being within three critical areas

1) Maintaining a realistic budget

2) Managing debt

3) Earning income, saving and investing

Optimization can range from understanding money better, handling the stress of debt, creating a financial roadmap to a healthier relationship with money and finances.

Core

Financial Literacy and understanding the tools and concepts to manage money – learn the basics facts of money and insightful resources (saving, investing, budgeting and taxes).

– Do you have a written financial plan? (That has your current financial snapshot and financial details)

– If you were to leave the earth tomorrow, who would manage your financial affairs – are those people prepared to take over your finances?

– Could we schedule a time to do an assessment of your financial landscape (income, expenses, assets, liabilities)